Ira return calculator

Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. For 2022 the maximum annual IRA.

What Is The Best Roth Ira Calculator District Capital Management

Enter the number of years until your retirement.

. That is 41667 in month one. Enter the amount of your contributions per year. Contribute Monthly Contribution Amount that you plan to add to the principal.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Enter your current IRA balance.

Traditional IRA Calculator Details To get the most benefit from this calculator you should use data that reflects your current financial situation. IRA Calculator Outputs You can either see summary statistics modeling your 401 k or 403 b or increase the resolution and graph your projections. An IRA can be an effective retirement tool.

Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. There are two basic types of individual retirement accounts IRAs. You can adjust that contribution down if you.

With our IRA calculators you can determine potential tax. We can also help you understand some of the key factors that affect your tax return estimate. The Roth IRA and the traditional IRA.

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. This calculator assumes that you make your contribution at the beginning of each year. While long-term savings in a.

The amount you will contribute to your Roth IRA each year. Check My Refund Status. Just input a few details including your age tax-filing status IRA contribution amount and expected rate of return and WalletHubs IRA calculator will tell you how much money to.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement. Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

To calculate the collective return of all three investments you would calculate the return of each depositso in the example 12 for the 12 months. Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. Use this Roth vs.

Simple IRA Calculation To see the. Initial Investment Initial Investment Amount of money that you have available to invest initially. Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year the.

If you dont have that information. While long term savings in a Roth IRA may produce better. Enter the percentage of your expected rate of return the.

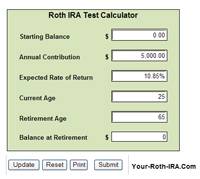

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Calculate Tax Free Amount At Retirement

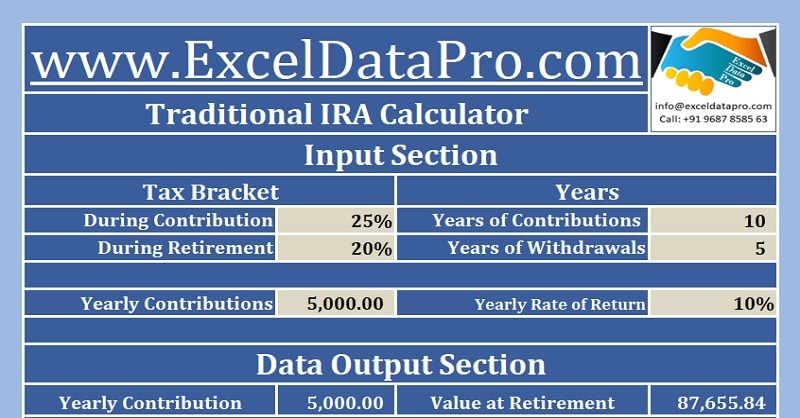

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Ira Calculator Excel Template Exceldatapro

Roth Ira Calculators

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Roth Ira Contribution

Roth Ira Calculators

Traditional Vs Roth Ira Calculator